Estimated tax calculator 2021

California Salary Tax Calculator for the Tax Year 202223 You are able to use our California State Tax Calculator to calculate your total tax costs in the tax year 202223. The Basic Tax Calculator BTC is designed to help you calculate the.

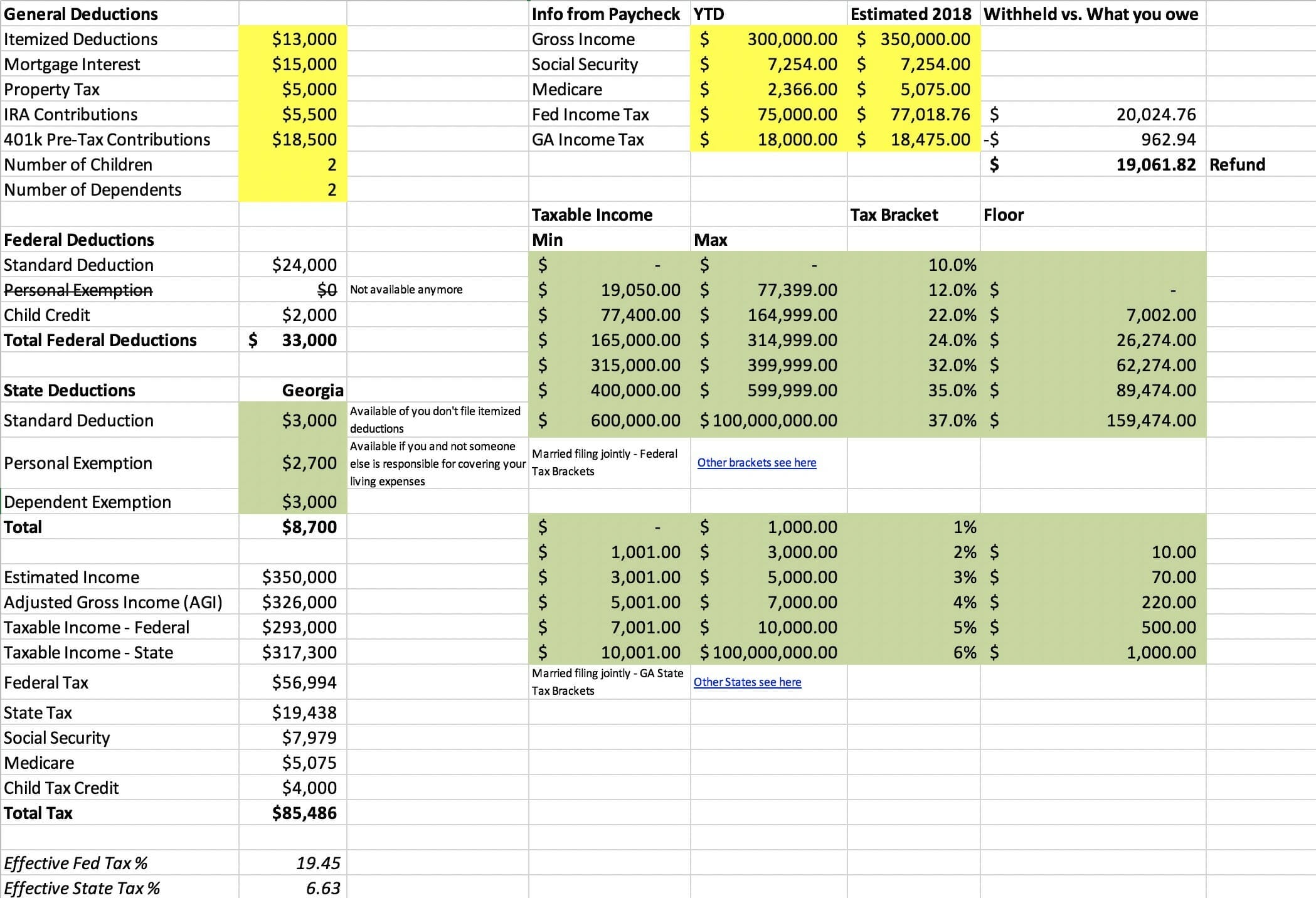

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

CT-2658-E Fill-in 1219 Instructions on form.

. Unlike your 1099 income be sure to input your gross wages. If you expect to earn about the same amount as last year you can take the amount of tax you paid on your 2021 return and divide it by four to figure out your 2022 quarterly estimated tax amount. Payments due April 15 June 15 September 15 2021 and January 18 2022.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Our office locator will help you locate your nearest office and you can book an appointment online. Key Takeaways If you expect to owe more than 1000 in federal taxes for the tax year you may need to make estimated quarterly tax payments using Form 1040-ES or else face a penalty for underpayment.

Calculate your estimated tax return. Your income tax must be paid throughout the year through tax withholding or quarterly payments and. Income Tax Calculator.

The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset. This box is optional but if you had W-2 earnings you can put them in here.

Calculate Your Estimated Income Tax Payments with Form 1040-ES so You Do Not Owe too Many Taxes. Income Taxes By State. Estimated Chargeable Income ECI Filing.

For more information read about quarterly estimated tax payments. The due dates are. Form number Instructions Form title.

You can still make estimated tax payments even if you expect that your tax after all credits will be less than 1000. Estimate Your 2022 Tax Refund For 2021 Returns. Please be mindful that our tax calculations are only estimates.

Retirees If youre retired or will retire in 2021 you may need to make estimated tax payments or have Oregon income tax withheld from your retirement income. Your household income location filing status and number of personal exemptions. Do You Need to Make Estimated Tax Payments.

If your federal income tax withholding plus any timely estimated taxes you paid amounts to at least 90 percent of the total tax that you will owe for this tax. The provided information does not constitute financial tax or legal advice. Year 20212022 estimated tax.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Tax Payable 17. April 15 first calender.

Your taxable income places you in the following tax brackets. Adding this estimated income tax to your self-employment tax of 9890 gives us the amount you should make in estimated payments over the course of the year. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. 2022 than you did in 2021. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

Please note that this calculator is intended to be used by those with incomes under 150000. State Tax Forms for 2021 and 2022. All information on this site is provided for educational purposes only and does not constitute legal or tax advice.

This simple calculator can help you figure out how much you may want pay. Tax Computation Chargeable income before deducting exempt amount. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Certificate of Exemption from Partnership Estimated Tax Paid on Behalf of Corporate Partners this version expires on February 1 2022 IT-2105 Fill-in. Your household income location filing status and number of personal exemptions. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document.

Your household income location filing status and number of personal exemptions. This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for Our calculation assumes your salary is the same for and. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour.

Click on any state to view download or print state tax forms in PDF format. See TSB-M-1610C Changes to the Mandatory First Installment of Estimated Tax for Corporations for more information. How Income Taxes Are Calculated.

E-Learning Videos Webinars Seminars on Corporate Income Tax. How Income Taxes Are Calculated. You can use our free Colorado income tax calculator to get a good estimate of what your tax liability will be come April.

The underpayment of estimated tax penalty calculator prepares and prints Form 2210. 100 of the taxes shown on your 2021 Tax Return. Find out your tax refund or taxes owed plus federal and provincial tax rates.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Canada Federal and Provincial tax brackets. You can use the four estimated tax vouchers included in Form 740-ES to mail your estimated payments to the Kentucky.

Ninety percent of the tax on your 2021 annualized income. Club ABC has chargeable income of 36000 for YA 2021. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

We strive to make the calculator perfectly accurate. Reason for filing Request full penalty waiver Request partial penalty waiver Income varied during the year Lower penalty using actual dates rather than equal payment due dates Filed a joint return for or but not both. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

To avoid the IRS underpayment penalty you can choose between the following approaches. If you use this method but end up earning more money in. This form has a new mailing address.

To find out what your final tax return summary will look like call 13 23 25 and let our tax accountants walk you through the tax refund process with ease. Meaning your pay before taxes and other payroll deductions are taken out. The federal income tax consists of six marginal tax brackets ranging from a minimum of 10 to a maximum of 396.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. That works out to 4273 in quarterly estimated taxes or 1424 if you want to pay monthly. TurboTax free Canada income tax calculator for 2021 quickly estimates your federal and provincial taxes.

CT-300-I Instructions Mandatory First Installment MFI of Estimated Tax for Corporations. Estimated tax payments are due on a quarterly basis. W-2 income.

Our calculator has recently been updated to include both the latest Federal Tax. Attachment to Report of Estimated Tax for Corporate Partners. Taxes for Year of Assessment 2021 should be filed by 30 April.

How Income Taxes Are Calculated.

How To Calculate Federal Income Tax

Tax Calculator Estimate Your Income Tax For 2022 Free

2021 Tax Calculator Frugal Professor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

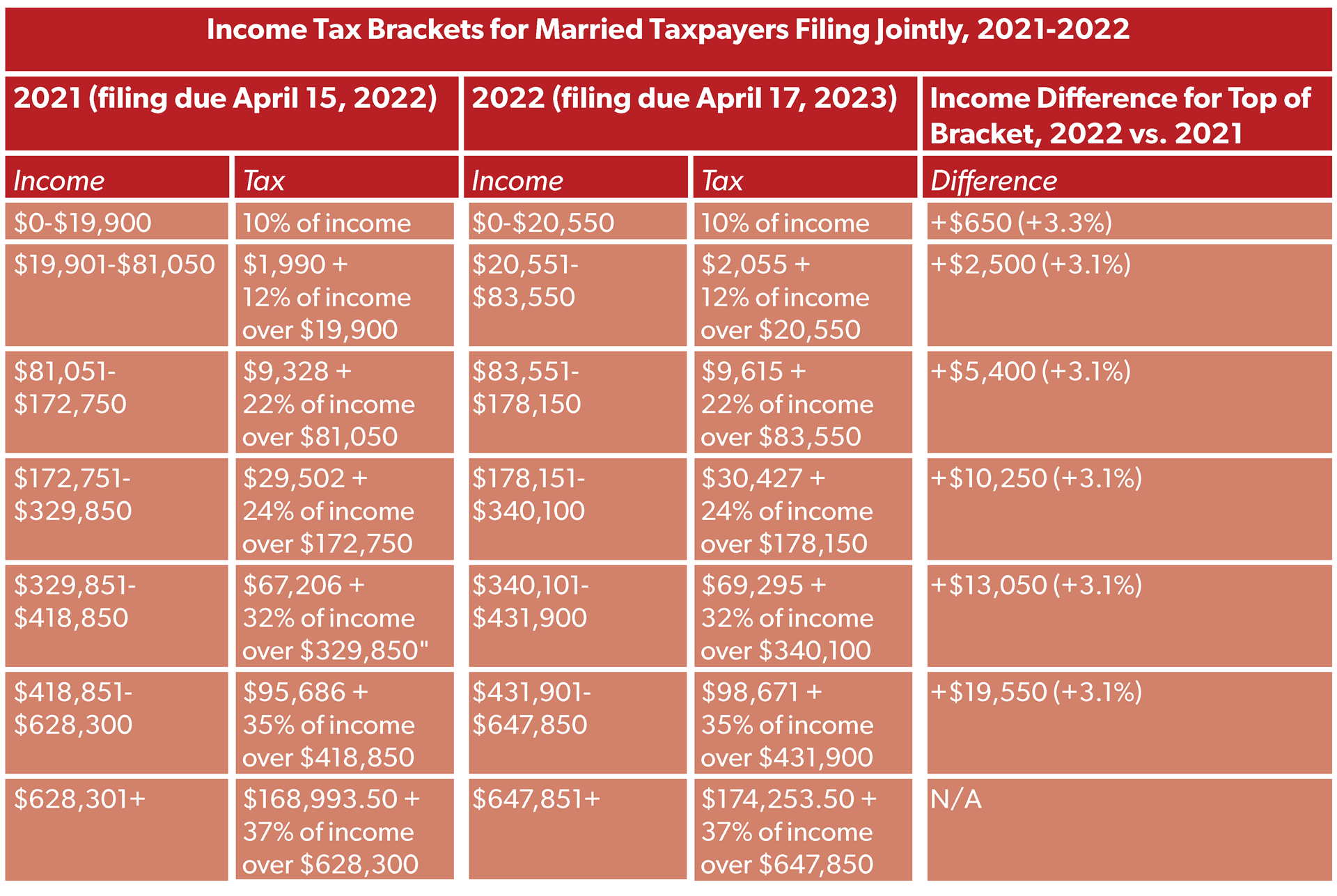

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

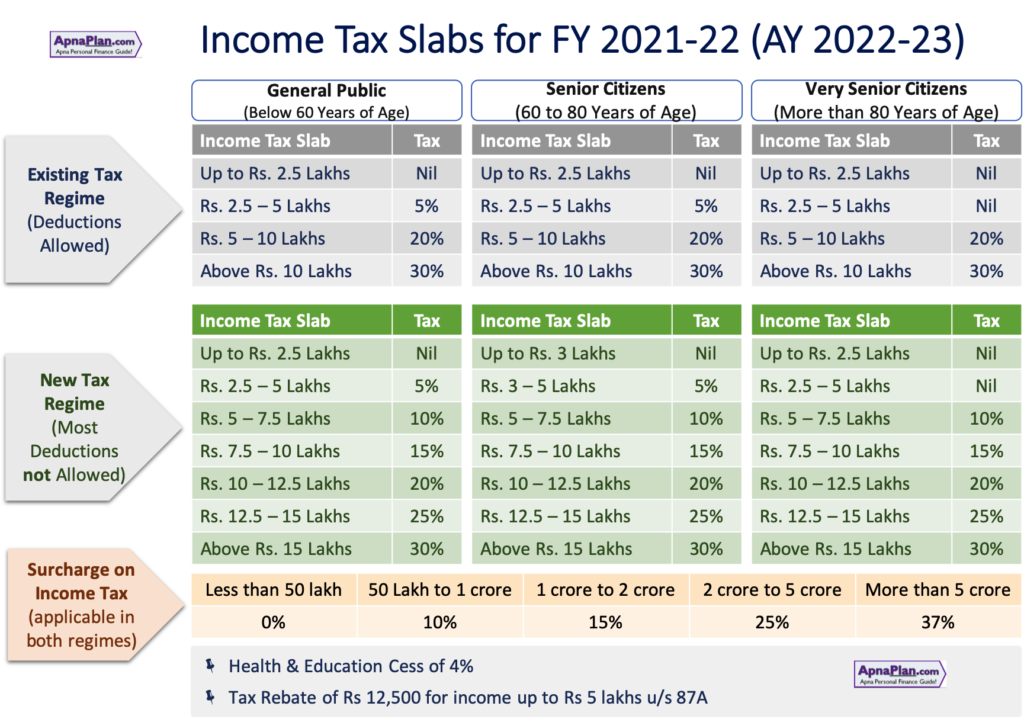

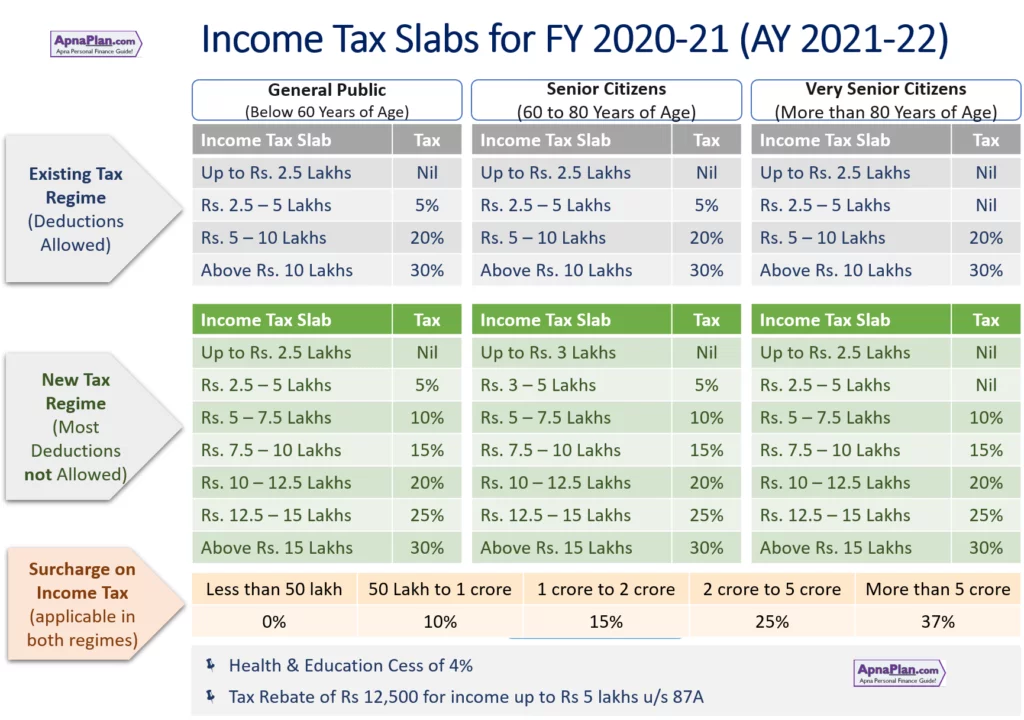

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

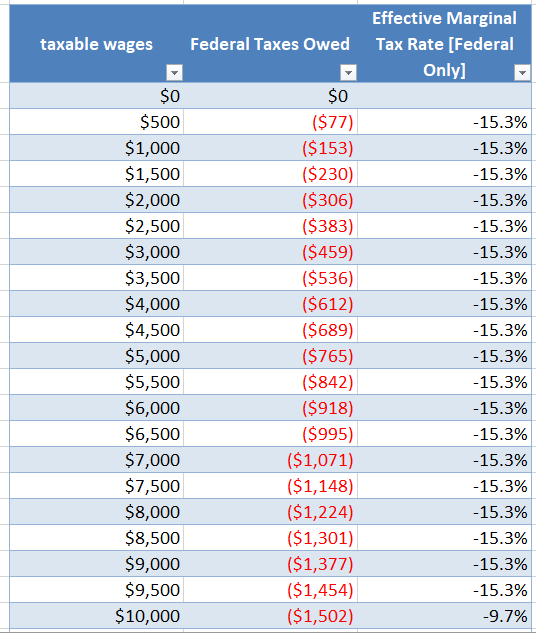

Calculation Of Federal Employment Taxes Payroll Services

Tax Year 2022 Calculator Estimate Your Refund And Taxes

How To Calculate Income Tax In Excel

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

How To Calculate Foreigner S Income Tax In China China Admissions

Budget 2021 Your Tax Tables Tax Calculator L A

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas